Table of Contents

ToggleEvery great journey begins with a single step, and for those who aspire to build wealth, the first step is often the most significant. For me, the start of my journey began as a mere boy when I used one piece of silver to purchase a young calf. This simple act of investing in something tangible marked the beginning of my path to financial stability and growth. It taught me a valuable lesson: the first step in building wealth is a turning point, one that every man must take if he wishes to move from earning with his hands to earning from the fruits of his investments.

The Power of Taking the First Step

A Shift in Mindset

- For many, the transition from relying solely on labor to generating income through investments is life-changing. It’s not just about money—it’s about adopting a mindset of growth and opportunity.

- That first investment, no matter how small, builds confidence and sets the foundation for future financial success.

The Beginning of Wealth Accumulation

- The young calf I purchased was not just an animal; it represented the start of something greater. Over time, that calf grew, and so did its value.

- In the same way, the first investment of any kind—whether it’s a stock, a small business, or even a savings account—can grow and multiply if nurtured properly.

Learning Through Action

- Starting early allows you to make mistakes, learn from them, and refine your approach. These lessons become invaluable as you make larger and more complex financial decisions.

Why Starting Early Matters

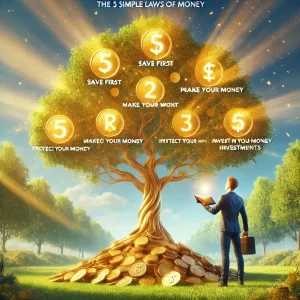

The Advantage of Time

- Those who take their first step toward building wealth at a young age have time on their side. Time allows investments to grow and compound, creating more significant returns over the years.

- Starting early gives you the opportunity to take risks, recover from setbacks, and still achieve your financial goals.

Outpacing Others

- Those who invest early often outstrip those who wait or hesitate. The simple act of beginning—however small—puts you ahead of those who never take that first step.

- Even a modest start can lead to substantial success when paired with consistency and time.

Avoiding the Regret of Delay

- Many people reach later stages of life wishing they had started saving or investing earlier. The regret of missed opportunities can be avoided by taking action as soon as possible.

The Tragedy of Never Starting

Living Paycheck to Paycheck

- Those who never take the first step toward wealth building often remain trapped in a cycle of earning and spending, with nothing to show for their years of labor.

Missed Opportunities

- Without investments, individuals miss out on the potential for their money to work for them. They rely solely on their physical efforts, which can diminish with age.

Financial Insecurity

- Failing to invest or save early often leads to a lack of financial stability in later years. This can result in dependence on others or an inability to enjoy life’s pleasures.

Advice for Those Starting Late

It’s Never Too Late

- While starting early is ideal, it’s never too late to begin. Even small, consistent efforts can lead to meaningful results over time.

- Focus on investments that offer steady growth and prioritize financial education to make up for lost time.

Learn from the Success of Others

- Study the habits of those who have successfully built wealth. Seek advice from experts, and avoid the pitfalls that others have encountered.

Final Thoughts: Take That First Step

The story of my young calf is a testament to the power of starting small but starting early. That single piece of silver was the seed that grew into my wealth, and the lessons I learned along the way shaped my financial journey.

Whether you are young and full of potential or older and determined to catch up, the most important step is the first one. Invest in something meaningful, nurture it, and let time and effort do the rest. The journey to wealth begins with action, and the sooner you start, the more prosperous your future will be.

Remember: the greatest luck any man can have is to take his first step toward wealth. Don’t wait. Start today, and let the seeds you plant grow into a thriving financial future.