Table of Contents

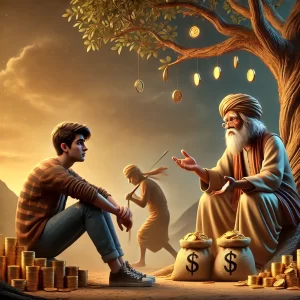

ToggleDid you know that the money you save today has the potential to work for you and grow into much more? The key to building wealth lies not just in saving, but in investing wisely. With the right guidance and strategy, your savings can become a powerful tool that earns you even more money over time.

The Power of Investing Your Savings

Many people think of savings as simply setting aside money for future use. However, money can do more than just sit in a bank account. When you invest your savings, you give it the opportunity to grow, multiply, and work for you, turning it into a more substantial amount over time. But to make this happen, it’s important to approach investments with care and wisdom.

Learn From the Wise: Seek Guidance Before Investing

When you begin to invest your savings, it’s essential to surround yourself with wise, experienced individuals who understand the best ways to handle money. These people are often skilled in the art of investing and know how to evaluate opportunities carefully before committing funds.

Why it works: By seeking advice from people who have experience in profitable ventures, you reduce the risk of making costly mistakes. You gain insights into safe, lucrative investments that can grow your wealth without jeopardizing your financial future.

Action Tip: Find a mentor or advisor who has a strong track record in investment. They can help you navigate complex decisions and recommend strategies that align with your goals and risk tolerance.

The Importance of Careful Planning and Research

A group of experienced investors often spends significant time discussing each potential investment opportunity before acting. Careful planning and research are key to minimizing risks and maximizing returns. They evaluate the risks and rewards associated with each venture, and they always prioritize securing the principal (the initial investment) over the potential for high but uncertain returns.

Why it works: By thoroughly researching investment opportunities and only pursuing those that have proven value, you are more likely to see positive results. Avoiding high-risk ventures ensures that you won’t lose your hard-earned savings.

Action Tip: Before investing, take the time to research and understand the opportunity. Look into the track record of the company or venture, and ensure that the investment aligns with your financial goals. Don’t be tempted by promises of quick returns—slow and steady growth is often the most reliable path.

Avoid Risky Ventures and Protect Your Principal

A wise investor knows that protecting the principal is just as important as earning profits. They are cautious about investing in ventures that are too speculative or unproven. By focusing on investments that offer security for the initial investment, they ensure that their money remains safe, even if the returns are modest.

Why it works: Avoiding risky investments that may not yield returns protects your financial security. If you lose the principal, you lose the opportunity to reinvest and continue building your wealth.

Action Tip: Be wary of high-risk investments that promise unusually high returns. Look for low- to medium-risk investments with proven success. Always diversify your investments to reduce the chance of losing everything in one venture.

Patience and Long-Term Planning Lead to Success

Successful investing doesn’t happen overnight. It requires patience and a long-term mindset. The group of wise men mentioned earlier understands this and focuses on investments that can grow steadily over time. They avoid making impulsive decisions and understand that real wealth is built through disciplined, consistent efforts.

Why it works: Patience allows your investments to compound and grow gradually. Over time, your returns accumulate, and the growth of your investments can far exceed any short-term gains from high-risk ventures.

Action Tip: When you invest, think long-term. Avoid the temptation to chase after quick, high returns. Stick to a plan and allow your investments to grow steadily.

Conclusion: Let Your Money Work for You

The idea of letting your money work for you isn’t just a dream—it’s a reality that can be achieved through smart, careful investment. By surrounding yourself with experienced advisors, conducting thorough research, avoiding risky ventures, and being patient, you can grow your wealth and secure your financial future.

Your savings don’t need to just sit in a bank account; they can be actively working for you. With the right approach and a little wisdom, your money can multiply, and you can enjoy the rewards of your efforts.